SCAM AWARENESS EDUCATION SERIES

What Real Regulation Looks Like: FINRA, FCA, ASIC Explained in Simple Terms

“Real” regulation isn’t just about having a license; it’s about oversight, accountability, and the power to punish. To understand what this looks like in practice, we have to look at the “Big Three” global watchdogs: FINRA (USA), the FCA (UK), and ASIC (Australia).

The Big Three: At a Glance

| Regulator | Region | Type | Primary Focus |

| FINRA | United States | Self-Regulatory (SRO) | Broker-dealers and individual brokers. |

| FCA | United Kingdom | Government Agency | All financial firms (banks, tech, crypto). |

| ASIC | Australia | Government Agency | Corporations, markets, and financial services. |

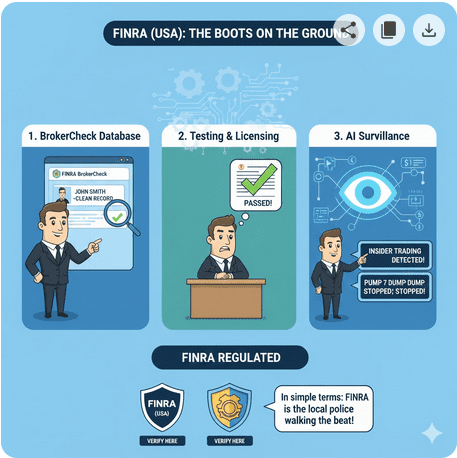

1. FINRA (USA): The “Boots on the Ground”

The Financial Industry Regulatory Authority (FINRA) is unique. It isn’t a government agency like the SEC; it is a non-profit authorized by Congress to oversee the “daily grind” of the brokerage world.

What it actually does:

The “BrokerCheck” Database: FINRA maintains a public record where you can look up any broker’s history, including past lawsuits or “red flags.”

Testing & Licensing: If someone wants to sell you a stock in the US, they have to pass FINRA’s rigorous exams (like the Series 7).

Surveillance: They use AI to monitor billions of market events every day to catch insider trading or “pump and dump” schemes before they spiral.

- Fun Fact: The SEC (Securities and Exchange Commission) helped create FINRA in 2007

In simple terms: If the SEC is the Supreme Court of the financial world, FINRA is the local police department walking the beat to make sure individual brokers aren’t lying to you.

2. FCA (UK): The “Gold Standard” for Conduct

The Financial Conduct Authority (FCA) is often considered one of the strictest regulators in the world. They don’t just care if a firm follows the rules; they care about the outcome for the customer.

What it actually does:

“Principles-Based” Regulation: Instead of just a list of “don’ts,” the FCA has 11 Principles. One of the biggest is “Treating Customers Fairly.” If a firm’s fine print is technically legal but intentionally confusing, the FCA will still fine them.

Market Integrity: They oversee everything from high-street banks to the latest crypto startups.

The Power to Ban: The FCA can stop a firm from operating instantly if they believe consumers are at risk.

3. ASIC (Australia): The “Market Referee”

The Australian Securities and Investments Commission (ASIC) is a “twin peaks” regulator. This means they focus specifically on market integrity and consumer protection, while a different body (APRA) focuses on the “safety” of the banks themselves.

What it actually does:

Corporate Watchdog: ASIC handles company registrations. If a company exists in Australia, ASIC knows who owns it and where they live.

Financial Literacy: They run “Moneysmart,” a massive public education initiative to help citizens avoid scams.

Strict Enforcement: ASIC is known for taking big banks to court. They don’t just issue fines; they aim for public “naming and shaming” to deter others.

Why Should You Care?

Choosing a broker or an investment platform? Look for these three names. It is the ultimate “vibe check.”

Safety of Funds: Regulated firms are often required to keep your money in “segregated accounts,” meaning they can’t use your savings to pay their own office rent.

Dispute Resolution: If a regulated firm treats you unfairly, you have a path to complain to an ombudsman. With an unregulated firm, your money is likely gone forever.

Transparency: Regulation forces companies to be honest about risks. If a site promises “100% guaranteed returns” and claims to be regulated by the FCA, they are lying—the FCA would never allow that language.

Remember, awareness is your strongest defense.

Contact us if you’d like more information on how cyber intelligence can help you locate scammers.

Please share this guide with friends and colleagues.

Stay up to date on the latest scam company alerts.

Advanced cyber tracking and profiling technology can identify where they are hiding.

Get in touch today and receive a free phone consultation.

GlobalMarkets AC Clone Website globalmarketsac.com

Seyrkule Luxembourg unauthorized trading website

ANF Luxembourg S.A. Clone Website

Lucrumia Group lucrumiaofficial.co Unauthorized Trading App

Freetradeeuropa.com et al Illegal Trading Websites

Forum One Imposter Clone Website forumone.eu.com

Zureon Global zureonglobal.com Unauthorized Trading

Logan Investment SA Luxembourg loganinvestment.lu Clone Website